o creep up in some cities. But a lot of things changed while brokers were huddled down in their storm cellars, and as skies begin to clear, they’re emerging to find a very different market landscape than they knew back in the heydays. Here are four of the key changes brokers should be mindful of:

Consumer behavior, attitudes and expectations. Home buyers are more independent and more demanding and they’re spending more time studying the marketplace before they’re ready to buy. Buyers and sellers expect to be able to research their options anonymously on the web, without any sales pressure, and they start earlier and research longer. When making inquiries of real estate professionals, they expect the information they want, when they want it and how they want it. Rushing people through the buyer lifecycle doesn’t cut it in the new market landscape. Nor does forgetting about them until they’re ready to make an offer.

Technology. It’s not just the Internet that’s changed things. Mobile, text messaging and social media are revolutionizing how consumers research, shop and share information about real estate listings. The number of consumers using tablets and smartphones has skyrocketed, and in fact more houses are now viewed on smartphones and tablets than a desktop, Zillow reported last week. In July, 168 million homes were viewed on Zillow.com via a mobile device – that’s 63 homes per second, compared to 21 homes per second just a year ago. Today a buyer standing at the curb can instantly get data about a property’s listing price, square footage, number of rooms, estimated valuation and past sales. Buyers can even get similar data for neighboring homes and schedule a showing.

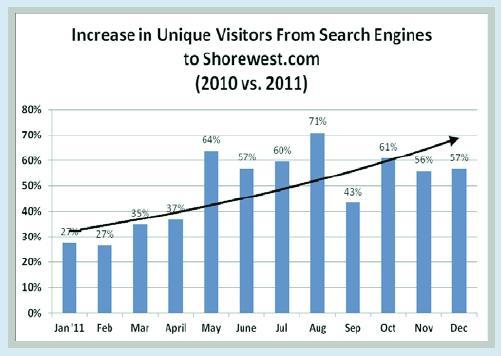

The competition. In 2007, back in the days when Zillow was losing money at a rapid clip, a broker’s main rival was the brokerage office down the street. Today, the competition is a battle over search engine visibility, and aggregators are winning the game. Zillow’s number of monthly visitors now exceeds 34 million a month (adding in Zillow’s mobile apps), the company is profitable and boasts a market value of more than $1 billion. That’s because third-party aggregators are dominating the information space (web search engines) where home buyers and sellers go first to educate themselves about their local housing markets. By consistently ranking at the top of organic search results, third-party sites have become gatekeepers to your clients. They’re also selling key marketing tools and services to your agents, and have become the voice of the real estate industry in the media.

Agents. Many agents are more tech-savvy than brokers -- they have a web presence, and are blogging and engaged with social media. Others are struggling with technology. Among both groups, agent loyalty is at an all-time low. Agents realize that their prospective clients are online but they’re frustrated by the low quality of the vast majority of Internet leads. They’re looking to brokers to help address the issue by using technology in more creative ways. They need brokers to engage and nurture potential clients throughout early stages of the buying process, taking more responsibility for online customer acquisition so agents can concentrate on closing transactions.

Has your brokerage changed with the marketplace? Unlike Dorothy in the Wizard

o creep up in some cities. But a lot of things changed while brokers were huddled down in their storm cellars, and as skies begin to clear, they’re emerging to find a very different market landscape than they knew back in the heydays. Here are four of the key changes brokers should be mindful of:

Consumer behavior, attitudes and expectations. Home buyers are more independent and more demanding and they’re spending more time studying the marketplace before they’re ready to buy. Buyers and sellers expect to be able to research their options anonymously on the web, without any sales pressure, and they start earlier and research longer. When making inquiries of real estate professionals, they expect the information they want, when they want it and how they want it. Rushing people through the buyer lifecycle doesn’t cut it in the new market landscape. Nor does forgetting about them until they’re ready to make an offer.

Technology. It’s not just the Internet that’s changed things. Mobile, text messaging and social media are revolutionizing how consumers research, shop and share information about real estate listings. The number of consumers using tablets and smartphones has skyrocketed, and in fact more houses are now viewed on smartphones and tablets than a desktop, Zillow reported last week. In July, 168 million homes were viewed on Zillow.com via a mobile device – that’s 63 homes per second, compared to 21 homes per second just a year ago. Today a buyer standing at the curb can instantly get data about a property’s listing price, square footage, number of rooms, estimated valuation and past sales. Buyers can even get similar data for neighboring homes and schedule a showing.

The competition. In 2007, back in the days when Zillow was losing money at a rapid clip, a broker’s main rival was the brokerage office down the street. Today, the competition is a battle over search engine visibility, and aggregators are winning the game. Zillow’s number of monthly visitors now exceeds 34 million a month (adding in Zillow’s mobile apps), the company is profitable and boasts a market value of more than $1 billion. That’s because third-party aggregators are dominating the information space (web search engines) where home buyers and sellers go first to educate themselves about their local housing markets. By consistently ranking at the top of organic search results, third-party sites have become gatekeepers to your clients. They’re also selling key marketing tools and services to your agents, and have become the voice of the real estate industry in the media.

Agents. Many agents are more tech-savvy than brokers -- they have a web presence, and are blogging and engaged with social media. Others are struggling with technology. Among both groups, agent loyalty is at an all-time low. Agents realize that their prospective clients are online but they’re frustrated by the low quality of the vast majority of Internet leads. They’re looking to brokers to help address the issue by using technology in more creative ways. They need brokers to engage and nurture potential clients throughout early stages of the buying process, taking more responsibility for online customer acquisition so agents can concentrate on closing transactions.

Has your brokerage changed with the marketplace? Unlike Dorothy in the Wizard Oz, brokers can’t just click their heels and return to the good old days. These fundamental shifts in behavior, attitudes and market structure are likely permanent and will become more and more evident as the market recovers. Since consumers are online and focused on self-service, for instance, the challenge is connecting with them by making their search as easy and efficient as possible.

Decisions about search engine marketing and website design should be based on attracting potential buyers and moving them smoothly through each of the stages of the home buyer lifecycle. Brokerages need to bring new digital technologies to the table to keep online prospects engaged throughout the journey and convert them into customers when they’re ready to buy. The critical capability going forward will be the broker’s ability to create relationships with consumers during the research and discovery phases of the buying process and to continuing to nurture them until the buyer has narrowed their choices and is ready to work with an agent.

If you haven’t fully embraced these trends and altered how you’re doing business, the housing market may spring back, but your business may not.

Oz, brokers can’t just click their heels and return to the good old days. These fundamental shifts in behavior, attitudes and market structure are likely permanent and will become more and more evident as the market recovers. Since consumers are online and focused on self-service, for instance, the challenge is connecting with them by making their search as easy and efficient as possible.

Decisions about search engine marketing and website design should be based on attracting potential buyers and moving them smoothly through each of the stages of the home buyer lifecycle. Brokerages need to bring new digital technologies to the table to keep online prospects engaged throughout the journey and convert them into customers when they’re ready to buy. The critical capability going forward will be the broker’s ability to create relationships with consumers during the research and discovery phases of the buying process and to continuing to nurture them until the buyer has narrowed their choices and is ready to work with an agent.

If you haven’t fully embraced these trends and altered how you’re doing business, the housing market may spring back, but your business may not.  To read the entire Shorewest REALTORS Customer Success Story follow the link, and don't forget to sign up for our blog!

To read the entire Shorewest REALTORS Customer Success Story follow the link, and don't forget to sign up for our blog!  agents and brokers. Several large brokerages are so unhappy with aggregators that they've turned off syndication in an effort to "get control" of their listings. But what's really at stake in this debate?

Ultimately, third-party aggregators are light years ahead in knowing how to take brokers' most valuable assets - their property listings - and in using them to attract large volumes of web visitors.

Here's three ways this hurts brokers and agents.

agents and brokers. Several large brokerages are so unhappy with aggregators that they've turned off syndication in an effort to "get control" of their listings. But what's really at stake in this debate?

Ultimately, third-party aggregators are light years ahead in knowing how to take brokers' most valuable assets - their property listings - and in using them to attract large volumes of web visitors.

Here's three ways this hurts brokers and agents. Q: What goes into good real estate photography?

A: It's harder than most people realize. Room photography is lighting, lighting, lighting. And when you photograph a home, you may be dealing with every kind of lighting — exterior lighting, incandescent, fluorescent — so without controlled lighting, every room is going to come out different. You may see a lot of bluish bathrooms and kitchens. Outside, you want to time the photograph to control for weird shadows; you also want to get rid of parked cars or garbage cans in the driveway.

And it takes a real camera. Technology is making it easier to shoot bad photos — camera phones don't have enough flash or depth of field (for rooms). Your drunk friend at a Cubs game, a camera phone is great for that. But if you have a room that's deep, you want to be able to see it.

In this video Maile Ohye from Google advises your small business as if she had only 10 minutes as your SEO consultant. The clip features advice catered to startups with main web content on less than 50 pages looking to rank only a handful of related search terms. Aesthetics and having a fancy site full or bells and whistles might be important for some, but when it comes down to it, nothing is more important than having searchable, indexable text.

The video is a little technical, but a reference for startups, nonetheless. Simple, effective, and useful.

In this video Maile Ohye from Google advises your small business as if she had only 10 minutes as your SEO consultant. The clip features advice catered to startups with main web content on less than 50 pages looking to rank only a handful of related search terms. Aesthetics and having a fancy site full or bells and whistles might be important for some, but when it comes down to it, nothing is more important than having searchable, indexable text.

The video is a little technical, but a reference for startups, nonetheless. Simple, effective, and useful. Brian Balduf, Co-Founder & Chairman of VHT Inc., shares his insights on the state of real estate marketing in VHT's newest white paper. Brian explores what he calls the "myth of marketing real estate to consumers" and shares what agents and brokerages need to do/avoid to make it a reality! The Internet has evolved into the perfect medium for real estate shopping: it’s quick, convenient and highly visual. It’s interactive, social and provides access to almost unlimited information.

So why hasn’t the message changed with the medium? Why are real estate web sites still taking data from old databases like MLSs and simply dumping it onto the web for public consumption? Consumers spend most of the buyer-life cycle / home-buying experience online and most of that time they are unrepresented. Therefore, agents have to market properties directly to buyers and sellers. But most agents’ tactics are the same as if they are still just sharing info with other real estate agents.

The Internet has evolved into the perfect medium for real estate shopping: it’s quick, convenient and highly visual. It’s interactive, social and provides access to almost unlimited information.

So why hasn’t the message changed with the medium? Why are real estate web sites still taking data from old databases like MLSs and simply dumping it onto the web for public consumption? Consumers spend most of the buyer-life cycle / home-buying experience online and most of that time they are unrepresented. Therefore, agents have to market properties directly to buyers and sellers. But most agents’ tactics are the same as if they are still just sharing info with other real estate agents.

Due to the popularity of our recent White Paper series (Found here: www.vht.com/news), we have decided to adapt these into a short video series. Today we have released the first in the series "The Lifecycle of Today's Home Buyer." This particular video gives some great insight into how consumer behavior has shifted over the past 10-15 years in the real estate industry. This is invaluable information for the modern brokerage, and something that every brokerage CEO must learn to survive!

Zillow’s head of “Partner Relations,” Bob Bemis, sent an email to brokers last week, urging them to “commit to sending Zillow a direct MLS-sourced data feed including agent photos and contact information.”

At least indirectly, the email acknowledged some key broker complaints about Zillow, such as how the site biases its listings to steer consumers toward advertisers rather than listing agents, and how its listings data is frequently outdated and stale.

According to Bemis, this “beta” program (called zPro) is evidence that Zillow has listened to brokers’ grievances, wants to try to address some of them, and is “ready to make this work.”

Well, wait just a minute. Reading between the lines in Zillow’s latest PR barrage, I had to stop and ask, What is really NEW here? And the answer is, not much.

Imagine if a website published inaccurate information about a celebrity’s personal life. But instead of apologizing, taking down the information and adopting controls to stop such errors from happening again, the website demanded a firsthand interview digging for even more personal details about the celebrity.

Would you call that blackmail?

If anything, zPro sounds like an backhanded effort by the mammoth listings aggregator, which thus far has shown little interest in assisting brokers, to get its hands directly on an even bigger slice of valuable broker data. Data that would provide fresh cheese for the mousetrap Zillow has set to catch lead-hungry agents in its CRM program.

In taking listings data from syndicators, Zillow is restricted in how it can use that data. But, if it can find a way to go around the syndication middlemen and convince brokers to just turn

Zillow’s head of “Partner Relations,” Bob Bemis, sent an email to brokers last week, urging them to “commit to sending Zillow a direct MLS-sourced data feed including agent photos and contact information.”

At least indirectly, the email acknowledged some key broker complaints about Zillow, such as how the site biases its listings to steer consumers toward advertisers rather than listing agents, and how its listings data is frequently outdated and stale.

According to Bemis, this “beta” program (called zPro) is evidence that Zillow has listened to brokers’ grievances, wants to try to address some of them, and is “ready to make this work.”

Well, wait just a minute. Reading between the lines in Zillow’s latest PR barrage, I had to stop and ask, What is really NEW here? And the answer is, not much.

Imagine if a website published inaccurate information about a celebrity’s personal life. But instead of apologizing, taking down the information and adopting controls to stop such errors from happening again, the website demanded a firsthand interview digging for even more personal details about the celebrity.

Would you call that blackmail?

If anything, zPro sounds like an backhanded effort by the mammoth listings aggregator, which thus far has shown little interest in assisting brokers, to get its hands directly on an even bigger slice of valuable broker data. Data that would provide fresh cheese for the mousetrap Zillow has set to catch lead-hungry agents in its CRM program.

In taking listings data from syndicators, Zillow is restricted in how it can use that data. But, if it can find a way to go around the syndication middlemen and convince brokers to just turn  over all their data, Zillow will be able to leverage various broker information such as agent contact info in order hook them on services such as its CRM program.

So is zPro just a Trojan horse to get inside the brokerage tent? Is it Zillow’s strategy about trying to appear like it’s making nice to brokers while it further undermines brokers’ value to their agent network? That’s sure what it looks like to me.

over all their data, Zillow will be able to leverage various broker information such as agent contact info in order hook them on services such as its CRM program.

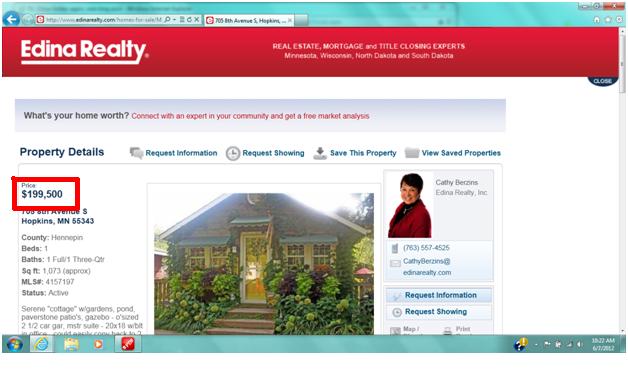

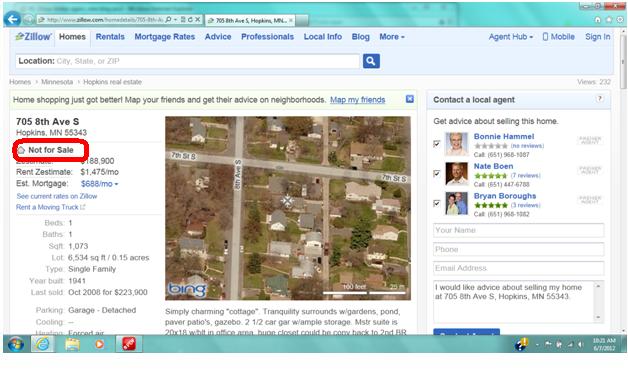

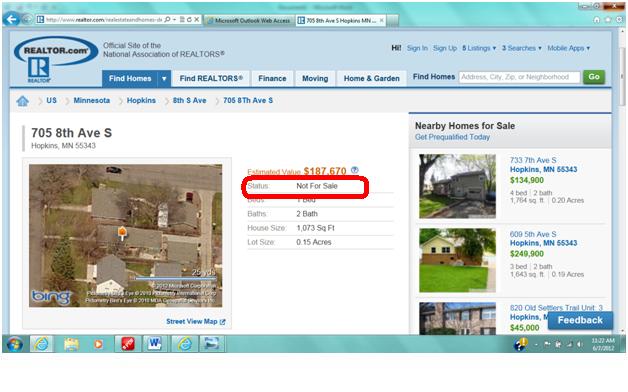

So is zPro just a Trojan horse to get inside the brokerage tent? Is it Zillow’s strategy about trying to appear like it’s making nice to brokers while it further undermines brokers’ value to their agent network? That’s sure what it looks like to me.  But on all three of the big portal sites (screen shots below), the same property is shown as off the market.

But on all three of the big portal sites (screen shots below), the same property is shown as off the market.

It goes to show just how dependent third-party portals are on the brokers’ giving them their listings to make their sites useful.

Edina Realty recently turned off syndication to third party aggregators because third party sites don’t have a way of ensuring accuracy and keeping property listings updated. As a result, on Zillow, Trulia and REALTOR.com, homes are listed for sale that aren’t really for sale, and homes that are for sale are shown as off the market.

When you combine this issue with wildly inaccurate home valuations and misleading agent contact information, there’s a whole lot of consumer confusion going on. A buyer who calls a brokerage because they saw a property for sale on Zillow winds up disappointed when they find out it sold months ago. The buyer doesn't understand (or really care) whose fault it is - they’re just inconvenienced.

Third party aggregators claim they’re trying to help publicize listings but they wind up making the whole industry just look bad.

No wonder press articles such as these in the Baltimore Sun and the Memphis Daily News are talking about how these data problems are undermining consumer confidence in online real estate sites.

It goes to show just how dependent third-party portals are on the brokers’ giving them their listings to make their sites useful.

Edina Realty recently turned off syndication to third party aggregators because third party sites don’t have a way of ensuring accuracy and keeping property listings updated. As a result, on Zillow, Trulia and REALTOR.com, homes are listed for sale that aren’t really for sale, and homes that are for sale are shown as off the market.

When you combine this issue with wildly inaccurate home valuations and misleading agent contact information, there’s a whole lot of consumer confusion going on. A buyer who calls a brokerage because they saw a property for sale on Zillow winds up disappointed when they find out it sold months ago. The buyer doesn't understand (or really care) whose fault it is - they’re just inconvenienced.

Third party aggregators claim they’re trying to help publicize listings but they wind up making the whole industry just look bad.

No wonder press articles such as these in the Baltimore Sun and the Memphis Daily News are talking about how these data problems are undermining consumer confidence in online real estate sites.

I couldn’t help thinking about this revenue issue last week when Zillow expanded its Premier Agent program to include agent web sites.

A few months ago, VHT’s Chairman, Brian Balduf, explained in a white paper that one of the biggest threats to brokers is the third-party aggregator sites and their aggressive push for new revenue streams. Brian predicted that this problem was going to worsen, and unfortunately, that prediction appears to be coming true.

Zillow’s agent services program is a huge wedge between agents and their brokers. These agent web sites will siphon money out of agents’ marketing spend, which could have been invested in brokerage marketing.

Worse yet, they’ll compete with brokerage sites for search engine rankings. I assume they’ll also provide further juice for Zillow’s already massive SEO program, making it even more difficult for brokers to obtain visibility in Google’s organic results.

Which means search engines will continue driving more homebuyers to third-party aggregator sites (where listings data is inaccurate, advertisers are favored over listing agents, valuation estimates are horribly off-base and search results are biased) rather to the web sites of brokers, who are the authoritative source of all listings data.

Besides selling leads back to brokers/agents on their own listings, Zillow is creating new revenue streams by selling services to agents – services that compete with those that brokers are providing to their agents. It’s building a business that usurps brokers’ relationships with their agents.

All this is another sign that it’s time for brokerages to take more responsibility for online customer acquisition and let agents concentrate on closing deals. Brokers need to reassert themselves on the Internet and aim their marketing resources at capturing online consumers before third-party aggregators do. This means directly engaging, assisting, tracking and nurturing potential clients during the early stages of the buying process – a task most agents don’t have the patience for anyway.

And brokers should refocus their value proposition to lead-hungry agents by providing them with plenty of potential buyers so they can focus on closing more sales. The more prospective clients a brokerage can bring to its sales agents, the less money it’ll spend buying leads from third parties, the more transactions the company will close, the more clients it will have and more loyal its agents will be.

I couldn’t help thinking about this revenue issue last week when Zillow expanded its Premier Agent program to include agent web sites.

A few months ago, VHT’s Chairman, Brian Balduf, explained in a white paper that one of the biggest threats to brokers is the third-party aggregator sites and their aggressive push for new revenue streams. Brian predicted that this problem was going to worsen, and unfortunately, that prediction appears to be coming true.

Zillow’s agent services program is a huge wedge between agents and their brokers. These agent web sites will siphon money out of agents’ marketing spend, which could have been invested in brokerage marketing.

Worse yet, they’ll compete with brokerage sites for search engine rankings. I assume they’ll also provide further juice for Zillow’s already massive SEO program, making it even more difficult for brokers to obtain visibility in Google’s organic results.

Which means search engines will continue driving more homebuyers to third-party aggregator sites (where listings data is inaccurate, advertisers are favored over listing agents, valuation estimates are horribly off-base and search results are biased) rather to the web sites of brokers, who are the authoritative source of all listings data.

Besides selling leads back to brokers/agents on their own listings, Zillow is creating new revenue streams by selling services to agents – services that compete with those that brokers are providing to their agents. It’s building a business that usurps brokers’ relationships with their agents.

All this is another sign that it’s time for brokerages to take more responsibility for online customer acquisition and let agents concentrate on closing deals. Brokers need to reassert themselves on the Internet and aim their marketing resources at capturing online consumers before third-party aggregators do. This means directly engaging, assisting, tracking and nurturing potential clients during the early stages of the buying process – a task most agents don’t have the patience for anyway.

And brokers should refocus their value proposition to lead-hungry agents by providing them with plenty of potential buyers so they can focus on closing more sales. The more prospective clients a brokerage can bring to its sales agents, the less money it’ll spend buying leads from third parties, the more transactions the company will close, the more clients it will have and more loyal its agents will be.